SAP takes care of tax calculation, tax postings, tax adjustments, and tax reporting through the three FI components; namely GL, AP, and AR. The processing of the following kinds of taxes is possible:

1. Tax on Sales and Purchases

a. Input Taxes (Purchase Tax)

b. Output Taxes (Sales Tax)

2. Additional Taxes (these are country specific and in addition to the tax on sales and purchases)

3. Sales Tax

4. Withholding Tax

a. Classic Withholding Tax

b. Extended Withholding Tax

SAP allows taxation at three levels:

1. National level or federal level (Europe, South Africa, Australia, etc.)

2. Regional or jurisdiction level (USA)

3. National and Regional level (India, Canada, Brazil etc.)

---

2. How is Tax Calculated in SAP?

SAP uses a technique called ‘Condition Method’ to calculate

taxes (except Withholding Tax) in the system. The system makes use of ‘Tax

(Calculation) Procedures’ defined in the system together with the Tax Codes

for calculating the quantity of tax.

1. The Tax Code is the starting point in the tax calculation.

The tax code is country specific, with every country having a country specific

Tax Procedure defined in the standard system, which is used as the template

for defining various tax codes. The system uses the tax code to verify

the following:

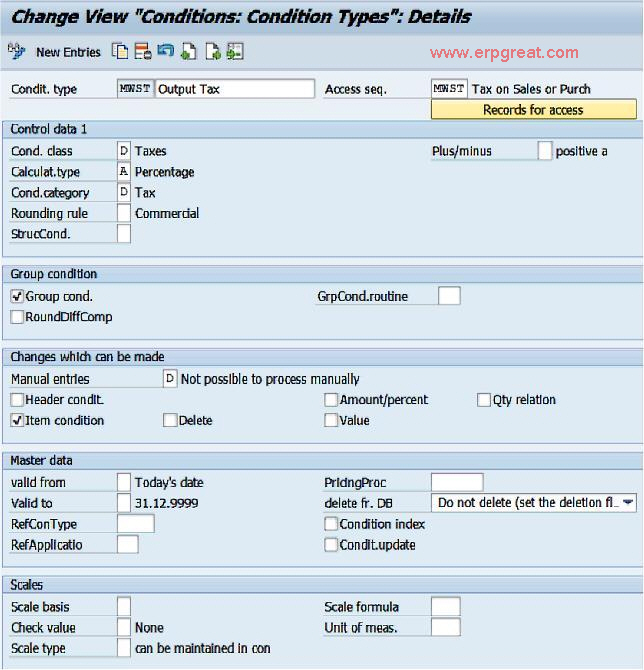

SPRO -> Sales and Distribution -> Basic Functions

-> Pricing -> Price Control -> Define Condition Type -> Maintain Condition

Types

Condition Type (Tax Processing)

a. Tax type

b. Amount of tax calculated/entered

c. GL account for tax posting

d. Calculation of additional tax portion, if any

2. Tax Rates are defined for each of the tax codes. The

tax rates are then associated with Tax Types, which are included in the

tax procedures. (Because of this relationship, it is technically possible

that a single tax code can have multiple tax rates for various tax types.)

3. The tax code is assigned to a Tax Procedure, which

is tagged to a GL master record. A particular tax procedure is accessed

whenever that GL account is used in document processing.

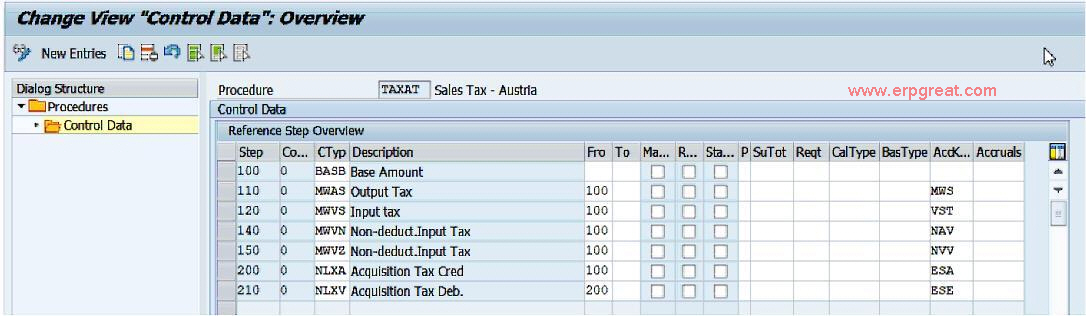

SPRO -> Financial Accounting -> Financial Accounting

Global Settings -> Tax on Sales/Purchases -> Check Calculation Procedure

-> Define Procedures

Steps in Tax processing

A Tax Procedure contains the following:

- Steps— To determine the sequence of lines within

the procedure.

- Condition Types— Indicates how the tax calculation

model will work (whether the records are for fixed amount or percentages

and whether the records can be processed automatically, etc.)

- Reference Steps— Where the system obtains the amount/value

it uses in its calculation (for example, the base amount)

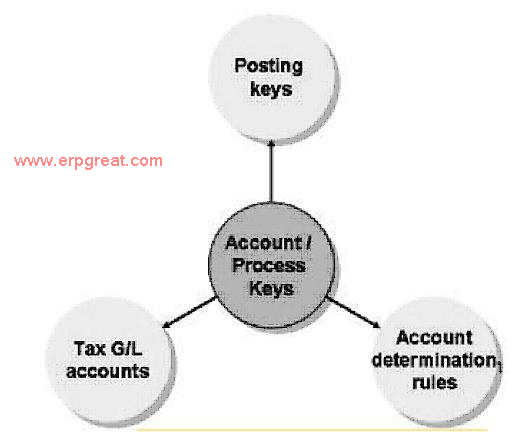

- Account/Process Keys— Provide the link between the

tax procedure and the GL accounts to which tax data is posted. This helps

in automatic tax account assignments. To enable that these keys have the

necessary information for automatic assignment, you need to define the

following:

- Posting keys (unless you have a specific requirement,

it will be sufficient to use the GL posting keys: Debit: 40, Credit: 50)

- Rules to determine on which fields the account determination

is to be based (such as the tax code or country key)

- Tax accounts to which the postings need to be made

SAP comes with a number of predefined account/process

keys, and it is recommended that the standard keys be used.

4. The Access Sequence helps in identifying the sequence

of Condition Tables to be used and identifying which field contents are

the ‘criteria’ for reading the Condition Tables (a group of Condition Types).

5. The tax amount so calculated is normally posted to

the same side as the GL posting that contains the tax code. When exchange

rate differences occur (due to tax adjustments in foreign currencies) these

differences are generally posted to the specific account(s) for exchange

rate differences. However, it is possible to specify (per Company Code)

that the exchange rates for tax items can also be entered manually or determined

by the posting or the document date, and the resulting differences posted

to a special account.

Account/Process Key for tax processing

6. R/3 has a number of predefined account keys, and it

is recommended that the standard keys be used.

---

3. Explain the Configurations Required for Taxes

in SAP.

You need to define the following to customize SAP for

this purpose:

1. Base Amount for Tax Calculation

For each Company Code you need to define whether the

Base Amount includes the cash discount as well. If the base amount includes

the discount, then the tax base is called ‘Gross,’ otherwise, it is ‘Net.’

You may also define a similar base amount for calculating the ‘Cash Discount.’

This also has to be maintained for each of the Company Codes.

2. Tax Codes

The Tax Code is a 2-digit code specifying the percentage

of tax to be calculated on the base amount. While defining the tax code,

you will also specify the ‘Tax Type’ to classify a tax code relating to

either ‘Input Tax’ or ‘Output Tax.’ The tax types are country specific

and determine how a tax is calculated and posted.

3. Tax Rate

The Tax Rate is the percentage of tax to be calculated

on a base amount. You will be able to define tax rates for one or more

tax types when you define a single tax code.

4. Check Indicators

By using the check indicators, you configure the system

to issue Error/Warning Messages when the tax amount entered manually is

incorrect.

---

4. What is a (Tax) ‘Jurisdiction Code’?

A ‘Jurisdiction Code,’ used in countries such as the

United States, is a combination of the codes defined by tax authorities.

It is possible to define up to four tax levels below the federal level.

The four levels can be the:

- Sub-city level

- City level

- Country level

- State level

Before you can use the jurisdiction codes for tax calculation,

you need to define the following:

1. Access Sequence (to include the country/tax code/jurisdiction

fields)

2. Condition Types (which references the access sequence

as defined above)

3. Jurisdiction Codes

The tax rates are defined in the tax code by jurisdiction.

When posting taxes with a jurisdiction code, note that the taxes may be

entered per jurisdiction code or per tax level.

---

5. Tell me about the ‘Tax Reports’ in SAP.

SAP comes delivered with country-specific default ‘Tax

Reports’ to meet your tax-reporting requirements. However, it is not uncommon

to use third-party software for the same purpose. As a process, it is recommended

that the ‘closing operations’ are completed before running the tax reports.

This will ensure that the system makes relevant adjustment entries (between

payables and receivables, exchange rate differences, etc.) so that the

correct tax amounts are reported.